CRA’s Transition to Online Mail: What Physicians with Business Accounts Need to Know

Effective June 16, 2025, the Canada Revenue Agency (CRA) will begin transitioning all business correspondence to online mail. This change will apply to physicians with Medicine Professional Corporations (MPCs), holding corporations, and unincorporated medical practices that are registered for GST/HST, payroll, or other CRA business program accounts. If a medical practice operates under a business number in any form, this update will affect how CRA correspondence is delivered.

Effective June 16, 2025, the Canada Revenue Agency (CRA) will begin transitioning all business correspondence to online mail. This change will apply to physicians with Medicine Professional Corporations (MPCs), holding corporations, and unincorporated medical practices that are registered for GST/HST, payroll, or other CRA business program accounts. If a medical practice operates under a business number in any form, this update will affect how CRA correspondence is delivered.

As part of this transition, the CRA will no longer issue paper mail for most business-related notices. Instead, business owners will be required to log into their My Business Account to view notices of assessment, installment reminders, GST/HST filings, and other important correspondence. It is the responsibility of the business account holder to monitor this online account regularly and ensure that contact information is current.

To avoid missing time-sensitive messages, it is essential to set up email notifications within the CRA account. Once enabled, an alert will be sent any time new mail is available in My Business Account. These notifications will not include sensitive details, but they serve as a prompt to log in and review any new correspondence. Email alerts will be sent with the subject line: “New mail from the Canada Revenue Agency / Nouveau courrier de l'Agence du revenu du Canada.”

The Registered Retirement Savings Plan (RRSP) contribution deadline to receive a tax deduction on your 2024 income tax return is March 03, 2025. The RRSP allows individual taxpayers to deduct the amounts contributed. The earnings (interest, dividends, capital gains), accumulate in the plan free of current tax so that they grow more quickly than the taxable earnings of investment made by the taxpayer directly in a taxable account would. Thus there are two benefits to an RRSP: first the current tax savings resulting from the deduction of contributions, and second the accumulation of tax-free earnings on money while in the plan.

The Registered Retirement Savings Plan (RRSP) contribution deadline to receive a tax deduction on your 2024 income tax return is March 03, 2025. The RRSP allows individual taxpayers to deduct the amounts contributed. The earnings (interest, dividends, capital gains), accumulate in the plan free of current tax so that they grow more quickly than the taxable earnings of investment made by the taxpayer directly in a taxable account would. Thus there are two benefits to an RRSP: first the current tax savings resulting from the deduction of contributions, and second the accumulation of tax-free earnings on money while in the plan. If you are a Canadian resident, you are taxed on your worldwide income from your employment, self-employment - professional income, and income or taxable capital gains from any investments or property you may own. You are not taxed on gifts you receive and certain miscellaneous types of income. If your income is sourced in another country, you will normally receive a tax credit in Canada to avoid double taxation.

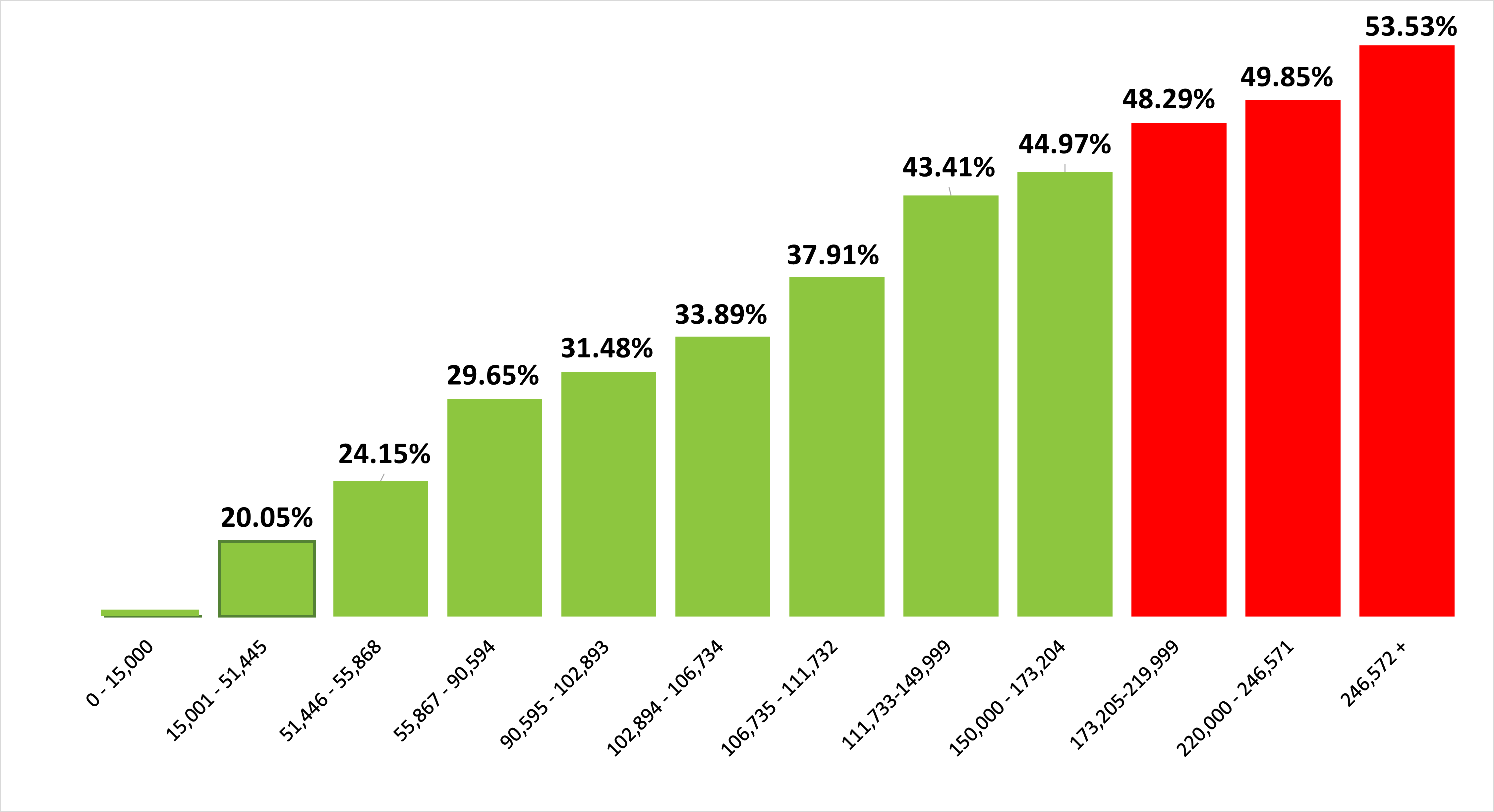

If you are a Canadian resident, you are taxed on your worldwide income from your employment, self-employment - professional income, and income or taxable capital gains from any investments or property you may own. You are not taxed on gifts you receive and certain miscellaneous types of income. If your income is sourced in another country, you will normally receive a tax credit in Canada to avoid double taxation. Canada’s income tax system levies federal and provincial taxes on individuals. Canada uses a progressive (graduated) income tax system where your earnings are taxed at higher rates (tax brackets) as your income increases. Tax brackets determine the rate of tax paid for each additional dollar of income within the defined bracket/threshold. Those with lesser incomes pay a lesser percentage of taxes on the income earned in lower tax brackets, while those earning higher incomes in higher tax brackets have to pay a higher rate of tax.

Canada’s income tax system levies federal and provincial taxes on individuals. Canada uses a progressive (graduated) income tax system where your earnings are taxed at higher rates (tax brackets) as your income increases. Tax brackets determine the rate of tax paid for each additional dollar of income within the defined bracket/threshold. Those with lesser incomes pay a lesser percentage of taxes on the income earned in lower tax brackets, while those earning higher incomes in higher tax brackets have to pay a higher rate of tax.