Insights – Taxes for Medical Doctors.

Keeping an eye on Canadian tax and business developments for Medical Doctors.

CRA’s Transition to Online Mail: What Physicians with Business Accounts Need to Know

As part of this transition, the CRA will no longer issue paper mail for most business-related notices. Instead, business owners will be required to log into their My Business Account to view notices of assessment, installment reminders, GST/HST filings, and other important correspondence. It is the responsibility of the business account holder to monitor this online account regularly and ensure that contact information is current.

To avoid missing time-sensitive messages, it is essential to set up email notifications within the CRA account. Once enabled, an alert will be sent any time new mail is available in My Business Account. These notifications will not include sensitive details, but they serve as a prompt to log in and review any new correspondence. Email alerts will be sent with the subject line: “New mail from the Canada Revenue Agency / Nouveau courrier de l'Agence du revenu du Canada.”

2024 RRSP contribution deductions and tax deferred income

You can deduct RRSP contributions based on the sum of your current year contribution limit plus your carryforward contributions. The maximum amount that can be contributed to your 2024 RRSP is the lesser of (1) 18% of your earned income from the previous year (wages/salary and self-employment income) or (2) $31,560 plus your carryforward contributions. You can obtain your 2024 RRSP contribution limit on your 2023 Notice of Assessment or at My CRA. If you exceed the maximum contribution limit, the excess amount will be subject to a 1% per month penalty until you correct the excess contribution by withdrawing the excess amount.

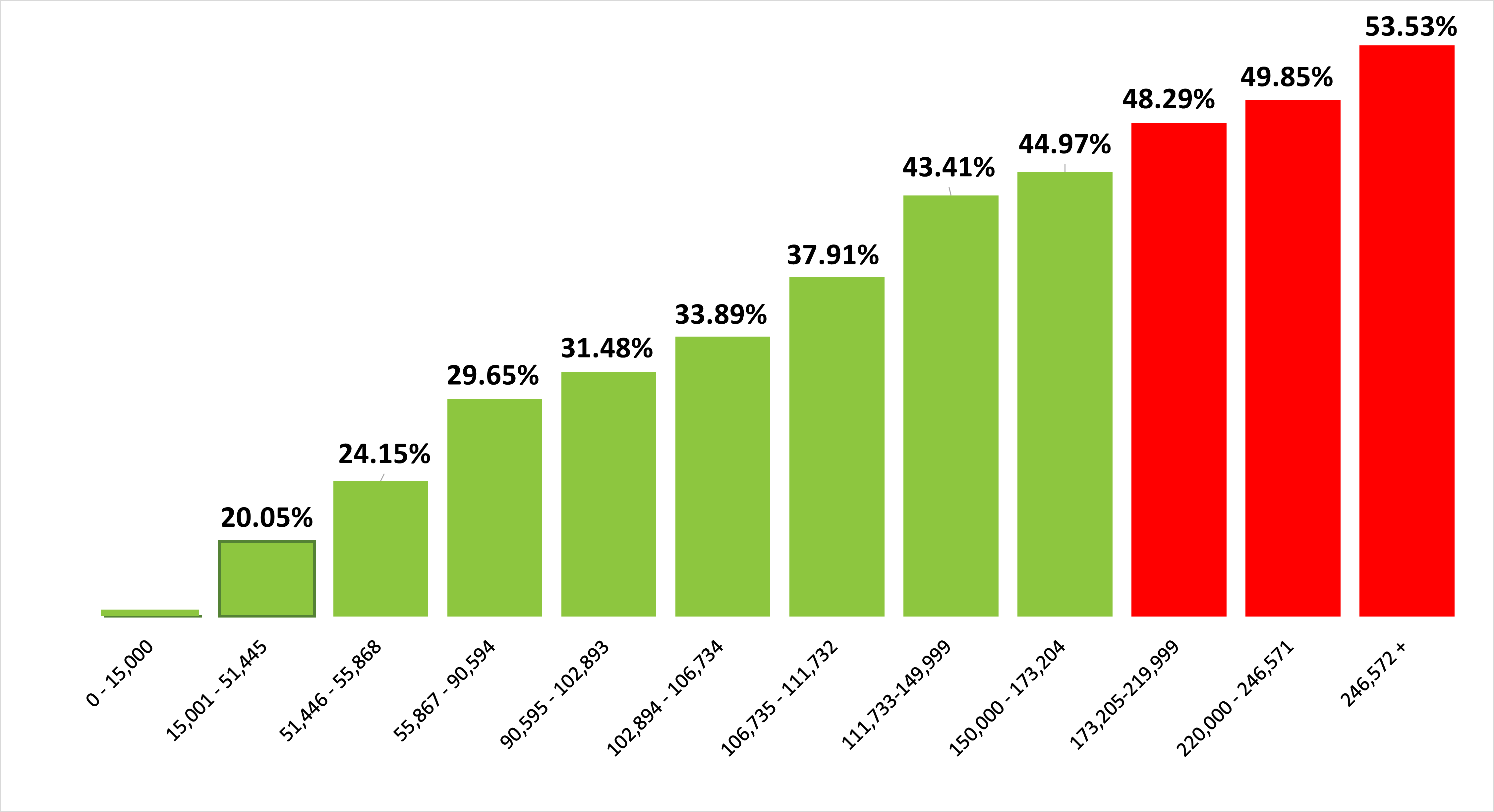

Taxes Payable by Individuals at Various Income Levels — Ontario 2024

Not all income is treated equally. For example, only 1/2 of capital gains are included in income. Most Canadian source dividends qualify for the gross-up and dividend tax credit mechanism that reduces the tax payable on the dividends for resident individuals. Certain employment benefits are received free of tax. Employee stock option benefits are currently one-half taxed in most cases.

Timing affects all revenue and expense items, professional income is generally taxable on an accrual basis, employment income when received, and capital gain and losses when realized or sold. The reporting of professional income is often a confusing concept for medical doctors since under the accrual method, you report income you earn during the calendar year, no matter when you receive it.

Personal Income Tax Brackets – Ontario 2024

In addition to federal income tax, provincial taxes are imposed by the province or territory in which you reside or carry on business or professional activities. Therefore, a physician working in multiple provinces or territories will be required to allocate their professional earnings between the various provinces or territories. Provincial tax rates, tax brackets, and credits vary by province and are calculated using the taxable income calculated under federal income tax rules on schedules accompanying the T1 Individual tax return.